.png?width=2000&height=600&name=Data%20that%20matters.%20(7).png)

"76% of consumers say they will avoid companies that do not treat the planet, community, and people kindly."

PwC Intelligence Series, June 2021

Introduction

As technology, software, and information channels continue to grow and expand, the number of data points increases with every click and grows exponentially. Not only are these sources churning out more data than we know what to do with, but a majority of it is more qualitative than quantitative. Lots of this data can be classified as environmental, social, or governance (ESG) information on the world around us, collected as we experience life through technology.

As these data points amass, the makeup of the people consuming and using this data is simultaneously changing–in today’s society, a majority of those who invest are millennials, followed closely by gen z. These generations are notorious for wanting to change the world for the better and are quickly learning that analyzing this deep pool of data is a way to quantify their monetary choices, forcing businesses to change the foundations of their data practices to keep up.

This intersection of data and people has resulted in the rise of ESG data as a critical factor in evaluating businesses for investments, partnerships, etc. Whether you’re familiar with the term or are brand new to ESG, we’ll walk you through where it started, where it’s going, and why it matters through the eyes of two asset management companies–one that adapts to change, and one that doesn’t.

"Data is the lifeblood of decision-making and the raw material for accountability."

United Nations

The Origin of ESG Data

Before we explore the history of ESG, we have to understand what it is and isn’t. These factors can paint a picture of an organization in a contextual way that money can’t, as this type of data won’t immediately appear on a balance sheet. The table below provides examples for each category of ESG Data.

The term ESG wasn’t coined until 2005 in the United Nations (UN) Principles for Responsible Investment (PRI) Report “Who Cares Wins”, yet it’s been around for much longer. In the 1960s, people began pushing investors to avoid investing in companies focused on tobacco, alcohol, or firearms, or those that used inhumane labor practices for production. This was later called the Socially Responsible Investment (SRI) movement, and was the predecessor to ESG. The biggest difference between the two is that with ESG, it’s assumed there is a financial relevance to what’s being analyzed–not just an ethical one.

The support for the UN’s report resulted in the creation of boards, foundations, and groups across global economies, including the Principles for Responsible Investment (PRI) at the New York Stock Exchange in 2006.2 In today’s financial market, there are thousands of ESG-focused jobs, databases, suppliers, and regulations ensuring that ESG data is included in decision-making.

"The volume of data in the world is increasing exponentially. In 2020, 64.2 zettabytes of data were created, that is a 314 percent increase from 2015."

United Nations

Environmental factors such as climate change and manmade and natural disaster increases push ESG data to the forefront of the external data industry. Companies promising to “go green” can be held responsible for their promises as more ESG data becomes available. There are other factors outside of the environment, such as movements like #MeToo and Black Lives Matter for companies to engage with consumers affected by these occurrences.

"ESG begins with E, but it does not end with it."

Marina Severinovsky, Head of Sustainability, North America, Schroders

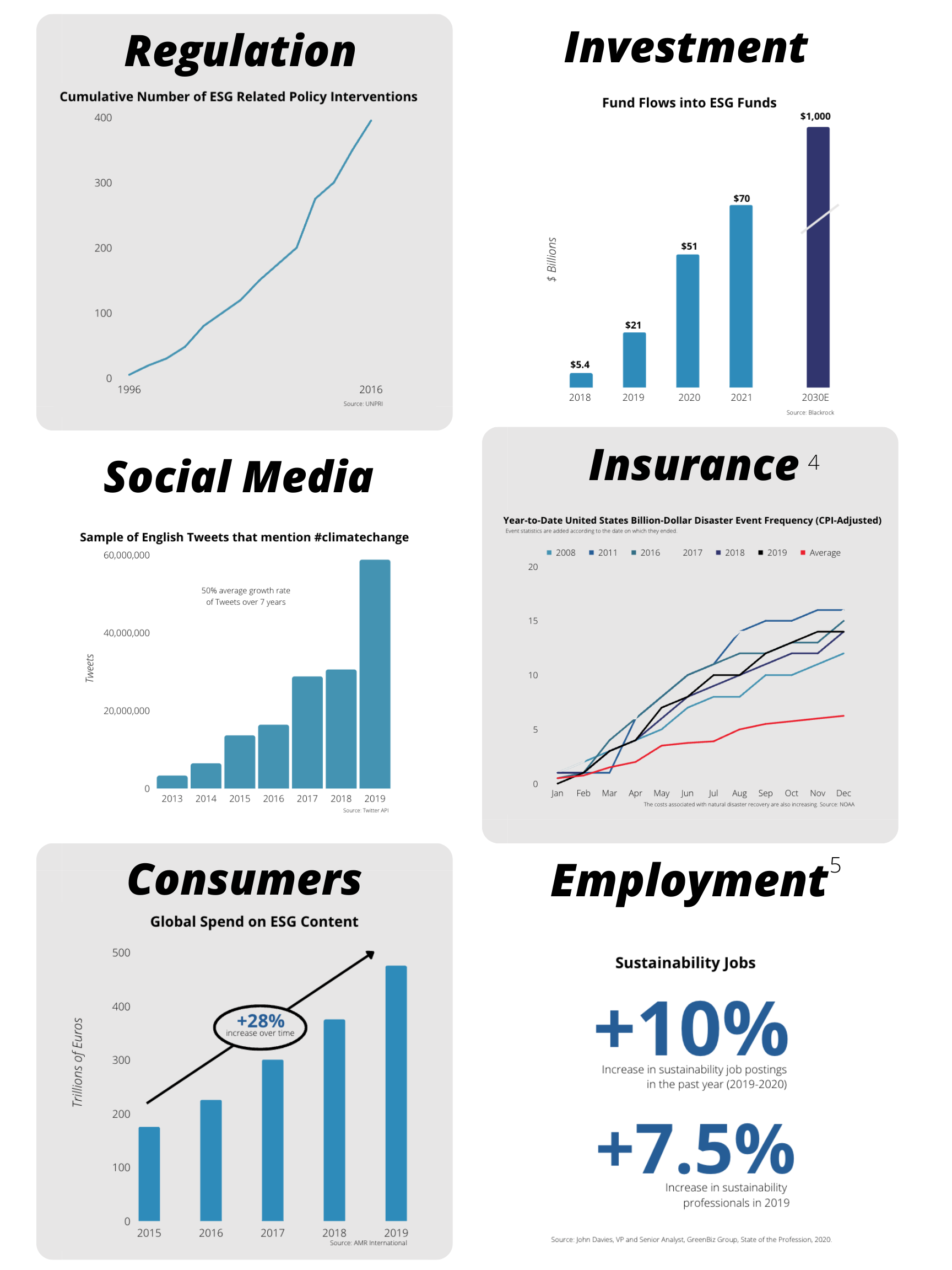

The charts below span a variety of industries and focuses–insurance, ESG suppliers and funds, social media, and legislation. The summation of these is clear: ESG is increasingly critical for business decisions in any industry, and it’s only just begun to disrupt the marketplace.

ESG influences industries across the board, and its impact can't be understated.

But like any good disruption, ESG data took the world by storm and is continuing to expand, whether organizations keep up or not. Today, it comes from a variety of highly fragmented sources and is unstructured and unstandardized. It’s one thing to know what ESG data is, and another to know how to use it for good. So how does it work?

The Necessity of ESG Data in Today's Economy

ESG data’s origin was a tool for asset management companies. There are four major drivers of the necessity of ESG data:

-

Consumer behavior is changing

-

More regulations and policies are focused on ESG

-

Investors are setting ESG benchmarks

-

Peer pressure is mounting as the industry shifts

These drivers are rooted in facts. According to the UNPRI, the number of ESG-related policy interventions has increased by 400% from 1996 - to 2016 and is even higher today. In 2018, only $5.4B was flowing into ESG funds. In 2021, that increased to $70B according to Blackrock.

Studies have also shown that disregarding the importance of ESG data can have a negative financial impact, whereas integrating it into your data pipeline and practices has a positive impact. These financial motivations are key in pushing companies and consumers to think of ESG data as a necessity instead of an option. According to the Mckinsey study “Five Ways that ESG Creates Value”, refusing to incorporate ESG data into your business carries significant risk for earnings before interest, taxes, depreciation, and amortization (EBITDA). These estimates for the percentage of shares at stake include:

- 50-60% for banking, automotive, aerospace, and tech industries

- 40-55% for transportation, logistics, infrastructure, telecom, and media industries

- 30-45% for energy, material, and resource industries

- 25-30% retail, pharma, and health

Consumers also drive the necessity for ESG data within a company’s data pipeline. Whether they’re inside or outside your organization, the demand for a focus on ESG is constant. According to the PwC Consumer Intelligence Series from June 2021, everyone sees the significance:

- 83% of consumers think companies should be actively shaping ESG best practices

- 91% of business leaders believe their company has a responsibility to act on ESG issues

- 86% of employees prefer to support or work for companies that care about the same issues they do

The benefits of ESG data don’t just meet requirements and mitigate risk–they also drive value. According to McKinsey, ESG data creates value in five key ways:

- Top Line Growth: customers–whether it’s B2B or B2C–are attracted to sustainability

- Cost Reductions: considering environmental costs like water and energy consumption is good for the planet but can also lead to lower bills

- Regulatory & Legal Interventions: governments often offer subsidies and support for companies who participate in their strategic initiatives

- Productivity Uplift: people want to work for companies that care–it’s that simple

- Investment & Asset Optimization: avoiding risky investments and planning ahead becomes easier

The technology, social media, and software industries will continue to grow, and so will the sheer volume of data available to anyone. As with any good trend, it’s important to consider what it will look like five years from now to proactively plan ahead.

What's Next

ESG data is no longer at play in finance and asset management. Its capabilities are transitioning across industries to retail, supply chain, and corporations. Executives ranging from law to ESG consulting firms are weighing in on what they think is coming next for ESG. What are they predicting for 2022?

Andries Verschelden, Co-founder and CEO of Good.Lab, an ESG consulting firm, shared his ten predictions for ESG data in 2022 on the company’s blog. The common theme among their predictions is increased structure and organization around ESG data, its usage, its formatting, and its importance in company strategy. They also predict ESG data will continue to spread to new industries as it becomes more commonplace and accessible.

Skadden, Arps, Slate, Meagher & Flom LLP and Affiliates is a multinational law firm headquartered in NYC. They shared five predictions for ESG’s impact in 2022:

- An increase in ESG-related legislation

- A usage in ESG data to win the war for talent in the employee market

- An increase in mental health campaigns

- An increase in government scrutiny for data and tech surrounding ESG

- The implementation of standard accounting practices for ESG

ESG data is here to stay, and it’s only going to become more ingrained in the way business is done globally.

How to Take Action

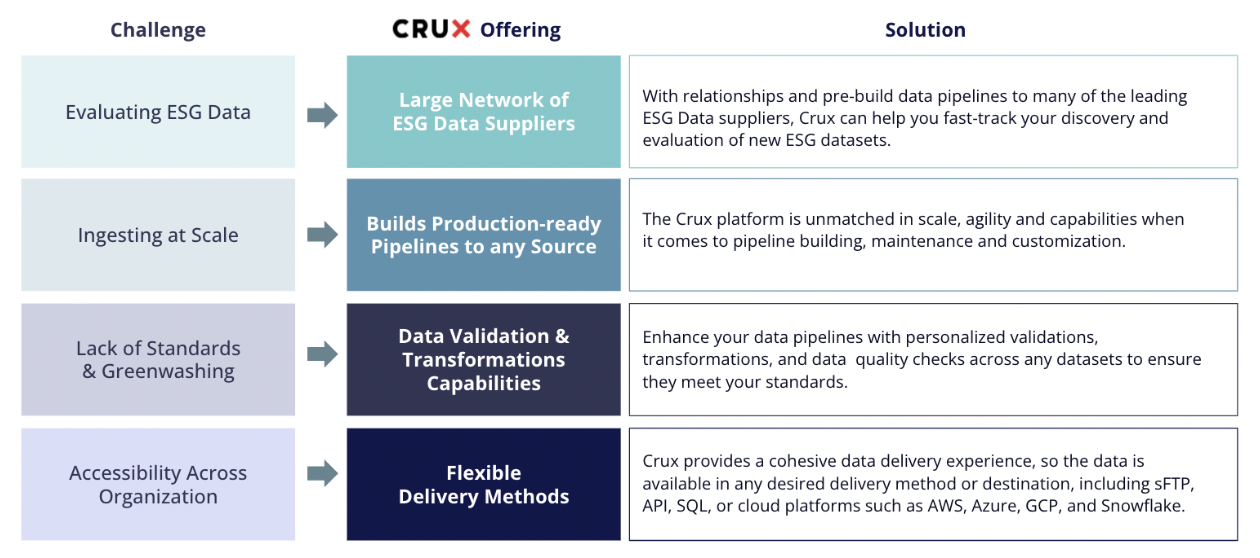

Whether you’re already intertwined with ESG or you're looking to get started, Crux can help. ESG data is still relatively new and comes with its own distinct challenges that only Crux can solve. Crux provides:

- A large network of ESG data suppliers with pre-built data pipelines

- Production-ready pipelines on the Crux platform that’s unmatched in scale, agility, and capabilities

- Data validation and transformation capabilities

- Flexible data delivery methods from FTP to API to cloud platforms

"Every company and every industry will be transformed by the transition to a net zero world. The question is, will you lead, or will you be led?"

Larry Fink, CEO, BlackRock